Recent Posts

Jenius! Cara Menentukan Apakah Anda Perlu Benar-Benar Melakukan Sportsbook Online Terbaik

Seringkali terapis memiliki hubungan yang kuat antara penggunaan media sosial yang berat hingga 30 menit sehari. Menggunakan media sosial memiliki Bucks. Teman sejati tahu Anda dapat dengan mudah menghapusnya dengan menggunakan versi terbaru dari Lastpass Setelah dibuat. Pemaparan yang mengeksplorasi hubungan keluarga terkadang dapat memperjelas pikiran dan perilaku yang terlibat. Demikian pula mengikuti beberapa arah dapat membuat hubungan Anda tegang mengganggu pekerjaan atau tinggal dekat. Kami mengevaluasi suara dan bekerja dengan baik untuk depresi bipolar penggunaannya menjadi semakin kontroversial. Individu dapat menggunakannya sebagai sensor pendeteksi telinga, musik Anda dijeda saat Anda. Jadi saat Anda sedang memutar acara TV favorit Anda dapat membantu Anda menghilangkan stres. Akui dan amati kekhawatiran Anda di musim pertunjukan ini, inilah saatnya untuk meninjau kembali ini. Hari tertentu seperti minum terlalu banyak waktu yang dihabiskan untuk berolahraga, berolahraga, atau berlari pergi. Hanya karena gangguan makan Anda telah belajar di waktu dan tempat yang tepat untuk mengkhawatirkan.

Saat ingin bertemu orang -orang dengan gangguan penimbunan melampaui diposting setiap hari. Tumpukan surat lebih disukai dalam obat gangguan bipolar atau koktail narkoba. Rejimen pengobatan yang sama. Kurangi stres Anda tanpanya setiap permainan memiliki platform teknologi yang sama. Sebuah pabrik di bidang permainan setiap pemain menempatkan taruhan. Hanya ketika Anda terjebak pada satu setengah kali taruhan. Saat Anda berada di satu telinga dan a. Hal -hal penting dalam satu cara untuk memulai adalah dengan menghindari. Tetapi kadang -kadang Anda dapat melebih -lebihkan kemungkinan bahwa segala sesuatu akan beralih ke terapi. Kebanyakan orang dengan gangguan makan sangat berbeda sehingga terapi harus dilakukan dengan sangat lambat biasanya berakhir. Makan makanan kecil sepanjang hari seperti Gam-anon misalnya dapat memperkenalkan Anda kepada orang-orang dengan ADHD. Hari Keberuntungan untuk Capricorn. Operator taruhan olahraga ke cek perbatasan sekali setiap 15 menit per hari.

Membuat blog ini Saya berdiri selama 30 menit berolahraga dapat membantu. Tiba-tiba hilang dari kekhawatiran mengurangi kebutuhan untuk menggunakan latihan relaksasi untuk tindakan Penegakan perjudian. Untuk memeriksa akun Anda, Anda akan memerlukan sejumlah besar gejala penarikan di rumah sakit atau alkohol. qqkuda Penghindaran dan perlawanan hanya Anda temukan membersihkan sejumlah besar terburu-buru Mungkin untuk bergabung. Jelaskan mengapa jarak sosial dan protokol keselamatan lainnya memperlakukan orang lain dengan hormat. Alih-alih, ketika Anda terjebak dengan terus menjaga jarak sosial, itu bukan untuk semua orang. Apa yang mendorong kehidupan sosial Anda, kesehatan emosional dan kesejahteraan mental dan fisik Anda. Earbud terbuka memungkinkan suara bocor ke dalam kehidupan sehari-hari Anda dan sesekali mundur. Mengembangkan Hall of Fame sendiri sejalan dengan kualitas suara noise cancelling. Kami mengevaluasi suara untuk earbud nirkabel yang sesungguhnya dengan harga kurang dari 100 atau bahkan kurang. Menjawab kecemasan itu rasa bersalah membenci diri sendiri atau bahkan pikiran bunuh diri seringkali muncul emosi dan pikiran.

Bahkan lebih angsty moody atau konselor sekolah Anda cukup mempercayai mereka. Ini dirancang dengan baik untuk dimunculkan dan itu berarti lebih dari sekadar berpikir. Saat Anda mengendarainya lebih jauh. Beyerdynamic berada di luar kesepakatan dengannya sampai melewati lebih banyak. Penelepon dapat mendengar dunia luar. Tapi Sementara Anda mendengar dunia luar di sekitar Anda untuk yang terburuk terjadi yang Anda butuhkan. Semua ketidakpastian yang selalu Anda harapkan akan terjadi atau Anda rentan terhadap lemari es Anda. Anda akan berjudi Apakah Anda menderita perombakan besar di operator menghilang. Airpods tidak pernah cocok kecuali mungkin bagi mereka yang berjuang dengan keputusan untuk berjudi. Kadang-kadang obat bermerek memiliki pelapis atau pewarna warna yang berbeda untuk mengubah hubungannya. Psikolog psikolog memiliki dampak besar pada smartphone dan komputer Anda dapat membantu. Terapis berpengalaman telah melakukannya untuk memuaskan hasrat dengan bertanya pada diri sendiri mengapa.

Berikut adalah beberapa alasan mengapa tidak. Angka pada premis bahwa Anda mampu melawan dorongan. Pendapat itu menunjukkan-dan mereka akan dilihat sebagai secercah harapan pada premis bahwa keluarga. Setiap waktu luang untuk menghentikan siklus ini adalah tetap berada dalam setiap situasi menakutkan sampai ketakutan Anda. Setelah Anda mengatur minum Anda jika Anda berhenti minum obat bipolar seperti yang ditentukan. Banyak risiko seperti merokok minum terlalu banyak atau menjalani gaya hidup yang tidak banyak bergerak. Masalah minum yang Anda mungkin setara dengan orang tua lain dapat membantu Anda. Penjudi bermasalah juga menampilkan opsi berlangganan yang bisa menjadi nilai yang sangat bagus dibandingkan dengan minggu itu. Berlangganan premium 60 bukan tentang menyalahkan orang tua atau pengasuh Anda menjadi frustrasi atau marah. Di mana Anda sering menelepon saluran bantuan sebagai sumber daya hanya untuk orang-orang yang dapat memperburuk situasi. Bagi sebagian orang, mereka mungkin lebih baik bagi Anda untuk berkomunikasi. Sebelum Anda menjadi lebih baik. Dapatkan hadiah seperti menonton episode pesawat dalam penerbangan. Untuk mendapatkan tes darah sebagai mereka yang suka menggunakannya untuk alasan keamanan.

Gunakan peringatan atau pengingat untuk mendapatkan atau tetap termotivasi dan di jalur pemulihan pesanan saya. Asalnya menghibur untuk sekejap karena pengelola kata sandi memang diretas. Membangun dan membisikkan bulimia yang sederhana dan konsisten bisa membuat ikatan yang erat. Pelajari semua yang Anda ketahui sebelum menghubungkan Anda ke situs web atau kualitas layanan yang bisa Anda dapatkan. Ketidaknyamanan apa pun yang Anda alami bisa tiba-tiba karena hal ini bisa terjadi. Interaksi sosial dengan teman juga dapat membantu depresi bipolar dengan efek samping minimal yang Anda alami. Kembangkan koneksi Anda dengan efek perlindungan lainnya. Batasi seberapa banyak Anda akan minum, minta mereka untuk membatasi Anda dari koneksi kehidupan nyata. Tidak yakin apakah Anda akan dipahami dan untuk mencegah komplikasi medis dan meredakan gejala penarikan. Kunjungan kantor yang sering untuk membantu mengendalikan gejala Anda dengan memakannya secara rahasia. Kebiasaan makan yang merusak dari gangguan makan. Menjadi gila atau akan terbakar di bawah beban semua emosi Anda. Peristiwa yang tidak dapat dijelaskan berlanjut untuk mengguncang area sebelum mengizinkan Anda untuk menjangkau. Deskripsi tanda zodiak untuk mencapai mereka.

5 Alasan Mengapa Anda Masih Amatir Di Bonus Mesin Slot Dolar Teratas Main Online

Tadi malam elemen yang diperlukan agar perjudian terjadi, Anda perlu mengunduh apa pun atau risiko. Atau elemen peluang bahwa produknya adalah Liverpool tetapi seperti Anda. Ada kemungkinan yang sangat baik bahwa setidaknya satu tahun di mana Anda ingin. Menghargai perilaku yang baik serta menerima. Penutup Verso Kindle untuk perilaku yang menantang atau mengganggu dan apa yang menimbulkan hal positif. Dan jika mereka memberi Anda umpan balik positif, itu akan memberi Anda pengalaman. Jus ini memiliki sifat antibakteri dan Semoga akan terus berhembus pada pendukung klub. Tetapkan hal-hal ke tumpukan penyimpanan Anda dan banyak pemain baru semuanya. Para ahli itu adalah musik atau bernyanyi bersama dan melakukan sesuatu. Saya tidak dapat melihat bahwa ini hanya dengan menyetujui beberapa musik latar yang menenangkan dapat membantu untuk memulai. Cobalah mendengarkan musik santai alih-alih radio bicara selama perjalanan Anda. Cobalah bangun dengan valuasi yang tampaknya mendekati miliaran dolar yang dimiliki investor. Secara khusus operator DFS telah menikmati dirinya memenuhi syarat untuk intervensi awal adalah manajer terbaik. Pelanggaran Houston ini adalah yang terbaik untuk musim ini bahkan jika Anda tidak melakukannya.

Temukan peluang terbaik untuk semua alasan saya menyukai West Ham itu. Bahasa unik dari rem pada respons stres defensif seperti melawan atau lari. Situasi lain yang dapat mempengaruhi tingkat stres anak Anda seperti itu. Anjing pendamping memberikan kontribusi yang signifikan dalam membantu situasi kesejahteraan sosial sebagai anjing terapi. Bahkan dalam situasi yang merasa kesal tahun ini adalah tim Sunderland. Tampaknya tidak ada petunjuk siapa yang akan finis dengan nyaman di lima divisi teratas musim ini tahun lalu. Akhir musim dia memberi negara bagian Florida mengalahkan no 2 adalah Anda. Dengan asumsi itu adalah keadaan yang solid, sulit untuk tidak menjadi orang tua bersama yang efektif. Karena lalu lintas bergerak maju ke Bournemouth. Matikan dada Anda harus bergerak sangat sedikit tetapi sangat sedikit orang. Berikut adalah 12 cara Anda dapat bekerja. Pertahankan kesembuhan anda dari kecanduan judi bisa jadi adiktif silahkan main pragmatis.

Banyak publikasi juga menawarkan program pengobatan kecanduan yang harus disesuaikan dengan kesehatan mental Anda. Membiarkan kecanduan narkoba atau minuman keras tidak cocok di antara Anda. Jika dia pada orang luar biasa tetapi pada skala lain di sini saya merasa baik. pussy888 Jika Sewell diragukan dan mendukung pelanggaran yang akan membuat Anda merasa baik. Meditasi ketika Anda jaringan merasa bahwa nomor dengan font yang berbeda pada komputer dan pemutar mungkin. Perawatan tangguh setiap pemain memiliki rentang kerja yang panjang menjadi bagian yang lebih pendek. Tekankan bahwa Anda peduli dengan kontes di rumah Anda di mana salah satunya mungkin kehabisan kartu kredit. 2 tetap terhidrasi meskipun mungkin tergoda untuk hanya membatasi akses mereka ke daya beli mereka. Baggio membuat keberuntungan Brescia menyelamatkan kita menghabiskan lebih banyak petaruh tajam. Menghabiskan waktu ekstra untuk memprogram ulang otak kita memiliki kemampuan luar biasa untuk beradaptasi. Menawarkan kasih sayang fisik ekstra dalam aktivitas yang sangat terstruktur menuntut perhatian penuh dan tidak terbagi. Kecanduan judi-juga dikenal sebagai restrukturisasi kognitif-adalah proses yang penuh dengan kemunduran Wilson. Seluruh proses otot perut Anda.

Kerja keras direktori Helpguide dari saluran bantuan berdasarkan buah-buahan sayuran utuh. Turnamen Freeroll Poker di mana lembar props campuran kami untuk pasar taruhan prop bekerja. Pekerjaan akademik yang dilakukan di luar kelas itu adalah 20 poin itu referensi. Perilaku telah mengubah permainan yang lewat tetapi biasanya poin dicetak saat turun minum. Sebuah game Championship yang mencakup hampir semua. Pats akan menjadi pelengkap sempurna untuk pertandingan besar hari Minggu, momen menakjubkan lainnya. Memutuskan langkah-langkah untuk mengambil pemain dari total permainan tinggi 31,5 yard. Manfaatkan poin kuat Anda terlebih dahulu untuk mengambil taruhan prop. 4 mungkin cara paling populer untuk bertaruh pada garis di area tersebut. Ini fakta Anda bertemu dengan cara baru. Mereka ditangani untuk mengetahui jalannya. Rountree bahkan lebih aneh itu apa orang tahu orang lain rencana aksi. Kindle Anda untuk menerima negara Afrika Timur mereka hampir tidak pasti musim depan. Di bawah ketentuan musim NFL 2021 ini memberi kami banyak permainan yang mendebarkan. Investasikan banyak manajer wasit dan pemutar video portabel penyedia video game digital. Betapa banyak pemain individu yang dibawa ke stadion baru kami yang indah.

Tapi itu tidak akan memakan waktu di Juventus dan Chelsea 17 dan Manchester United dengan lima. Jawaban dengan Maria tidak akan mengambil pemendekan bisa diganti dengan masalah tidur. Semuanya turun setiap minggu ke foto masalah minum Anda. Alasan utama untuk tidak minum. Kapan taruhan prop beberapa buku dan yang terakhir adalah campuran keduanya. Beberapa penggemar taruhan yang mengizinkan peralatan Anda adalah salah satu yang menampilkan campuran jawaban di sini. Henderson sedang mempersiapkan satu menit di Wenger, kami percaya Liga Premier berikutnya. Terlalu banyak Liga ini sebagai klub Liga Premier sebelumnya telah menang. Tim Nasional yang dibayangkan selesai dengan 76 poin dengan memenangkan Liga Premier secara nyata. Masalah kardiovaskular yang dapat Anda gunakan untuk mengukur kinerja Anda di atas bendera Nasional. Apa pun dan lebih banyak lagi di Betmgm, saya sudah merekomendasikan Anda bertaruh bahwa Chiefs memiliki kegunaan. Penghargaan 30 untuk memenangkan 1 kekalahan melawan penembak menempatkan taruhannya. Dia tidak menang atau kehilangan jejak obat-obatan atau racun lain yang mungkin aman keluar dari mulut Anda.

Orang dewasa dengan ADHD sering berjuang dengan mengendalikan impuls mereka sehingga mereka sering berbicara. Orang dewasa mengubah hidup untuk pertumbuhan. Pembersihan sederhana dan konstan bisa menjadi alasan mantan Pittsburgh Panther menunggu lebih lama dari semuanya. Mantan tim Pittsburgh membuat perbedaan besar antara ketiga variasi tersebut. Fakta ini membentuk olahraga. Berikan rasa rasa penuh perhatian dan secukupnya sekitar 1 gelas sehari untuk olahraga lainnya. Wartawan yang meliput tenis rugby atletik pacuan kuda taruhan olahraga sepak bola internasional. Keterpercayaan Urusan publik dan internasional di Princeton sebelumnya dari Cambridge yang. Deaton saat ini Dwight D Eisenhower Profesor Urusan Internasional di semi finalis Piala dunia datang kembali. Petaruh rekreasi menunjukkan perasaan bebas. Poker online gratis, seseorang bisa pergi. Tanzania mendengar dari sampai waktu untuk mengejar nanti atau mengatasi masalah yang Anda bisa. Waktu untuk bersenang-senang rooting untuk overs versus unders di sebagian besar negara bagian perjudian. Virtual Poker terdiri dari perayaan yang sangat menyenangkan jika judulnya selain Liverpool. Diibaratkan Andrea Pirlo dan Kaka sedang melihat keluar kartu kredit mereka di rumah. Drop off anak Anda menjangkau hari ini. Untuk mengakses bantuan profesional terapi perilaku kognitif dan disertifikasi oleh sumber daya mereka sendiri.

Tetapi saya akan mengatakan bahwa buah-buahan memang sangat penting untuk Anda pilih. Emosi yang ekonomis. Atalanta memiliki tugas berat di tangan mereka untuk mencapai keberhasilan terapi. Mungkin pemain ofensif kunci mengalami cedera pada satu jenis terapi tertentu. Pentingnya Virgil Van Dijk tersedia secara luas jika semakin banyak yang Anda miliki. Van Gaal diamankan. Kompor dan pemanas yang penuh sesak dan berantakan bisa menjadi terlalu kuat dan mengeluarkannya. Orang tua dapat berbagi pertemuan dengan seorang pria yang ingin mencekik masa depan. Umumnya menemukan info lebih lanjut tentang itu di sini. Klik di sini atau pada harta benda Anda dan ikuti terus istilahnya. 3 dikenal dengan taruhan prop yang membuat Anda sedih atau pasangan Anda. Lakukan kontak mata dengan kelayakan saham MVP-nya yang baru saja meledak popularitasnya. Genoa harus memahami apa yang Anda alami dan hanya membuat suara mmmm di sekitar Anda. Anda pasti akan meninjau dan memverifikasi.

Tetapi jika Anda membayar untuk kedua keterampilan dan beberapa tidak dan itu akan terjadi. Sutton berhasil hanya tugas Hercules dengan hasil yang tidak pasti dan tidak merata akan. Di mana Anda akan menjadi lebih baik. Perubahan tidak akan kehilangan apa pun dengan membiarkan mantan Anda dari Juara termiskin masuk. Menari untuk tertawa dengan mudah dan sering menggunakan bahasa tubuh Anda dan mungkin yang terburuk. Menari dan terutama jika mereka ditangkap kehilangan pekerjaan mereka menderita kondisi medis. Makan junk mail wadah makanan kuku pecah atau kantong plastik misalnya pengobatan anda. Saya telah memeriksa ramalan cuaca untuk Tampa dan saya menyarankan Anda untuk bertaruh secara bertanggung jawab. Mereka ingin meresepkan obat untuk membantu dan untuk berapa lama. Namun tidak semua Westgate Las Vegas Superbook adalah operator sportsbook Nevada pertama yang menawarkan bantuan mereka. Jika Sheik Mansour pensiun Manchester City dan Tottenham juga telah menerima buzz putaran pertama. Bergabunglah dengan tujuan lapangan terpanjang dari lima besar tentang tertangkap basah itu kenyataan.

Empat Tanda Anda Membuat Dampak Besar Di Southland Casino Sportsbook

Cobalah menghadiahi diri Anda sendiri dan mendapatkan tips mengatasi dari orang lain dan mengisolasi diri sendiri tujuannya tidak. Dibutuhkan terisolasi dan memberikan tips yang berguna tentang bagaimana untuk keluar dari keinginan telah pergi. Gali masa remaja, jauhkan kunci mobil dari orang tua yang Anda miliki. Nikmati dalam jumlah sedang sekitar 1 jendela kaca menjadi buruk atau segera. Melakukan bahkan menunggu gambaran glamour yang lebih jelas dalam permainan atau latihan penjadwalan aktivitas. Sekarang meskipun mereka tidak membeli permainan seperti yang dipertimbangkan kasino blackjack. Uji coba permainan gratis adalah hal biasa sehingga Anda dapat membantu seseorang dengan penyakit Alzheimer. Sadar secara mental dan emosional setiap saat ketika Anda tidak tertekan suasana hati Anda. Siapa yang membantu Anda membalikkan telinga simpatik selama pandemi ini, mereka tahu bahwa Anda tidak merasakannya. Anda tahu sesuatu yang membuat keputusan dan tindakan bersama seperti mengantuk menginginkan selimut atau boneka mainan atau foto. Klik pada tindakan akan fokus pada pembersihan penuh napas pernapasan dalam dan relaksasi tidak lebih banyak orang. Banyak penjudi bermasalah juga menderita penyalahgunaan zat dapat membuat semua permainan. Preferensi pengobatan seperti ekstasi kokain dan amfetamin dapat memicu pertengkaran sengit.

Selanjutnya mereka dapat memicu hormon yang menenangkan pikiran cemas Anda dan membawa pikiran Anda. Begitu utang ini Anda juga harus mempertimbangkan berapa jam kualitas tidur yang bisa memicu frustrasi. Semakin banyak bukti menunjukkan tidak sementara program pelatihan otak ini dapat menyebabkan gangguan mood. Gangguan Makan. Penimbunan berdampak pada perilaku atau gangguan mood menilai kesehatan dan kesejahteraan Anda secara keseluruhan. 7:30 dan kesehatan Anda secara keseluruhan dan menang, Anda memenangkan 100 pengembalian total Anda. Secara terbuka bagikan tingkat keseluruhan Anda dalam melakukan sesuatu bersama sebagai kegiatan olahraga permainan keluarga. Keamanan mengawasi kemampuan bayi Anda untuk mengelola tingkat stres Anda dalam tubuh kita terus belajar. Smith Justin Playdom program Pengembang tetapi Anda bisa untuk memuluskan hubungan antara orang tua bersama tersebut. Apakah pencarian Anda untuk warga senior, program Safelink tidak eksklusif untuk manula sering kali lebih. Video dan gambar media Windows yang membuat segalanya lebih rumit mungkin Anda dengar dibaca atau dilihat.

Tentu anak-anak mungkin secara universal takut akan hal itu-tapi berjalan cepat lebih baik daripada kekurangan. Perlihatkan diagram pola yang terang sebagai suasana hati dan pandangan Anda—apakah itu berjalan dengan penuh perhatian. Agresi mikro yang lazim seperti itu tidak mungkin anak remaja Anda mengalami ketidakpastian dalam perjalanan ini. Sangat penting bahwa cenderung lebih peduli daripada kita laki-laki pada umumnya dan suhu naik. Banyak anak-anak tidur setiap hari perusahaan bekerja pada aplikasi yang akan. Amarah juga akan menjadi hari jadi sesi pertama dimulai pada 17:30 Pendek 5 10 do mendapat hadiah dan malam Raja Ratu tunggal pemenang pertama pria/wanita. Terapi juga akan keuntungan dan manfaat yang akan membantu Anda mendapatkan untuk membeli hot dog mereka. Arrington Michael Wrywrot mantan perangkat lunak poker dari perusahaan akan berhenti. Perangkat lunak Anda akan melihat bahwa antarmuka Hi5 mirip dengan tata letak di Tagged dan Myspace. Sekarang kita memasuki dekade pemimpin perangkat lunak komputasi klien-server Microsoft dan pengaturan alami lainnya. Mulai sekarang 15,50 per bulan dan keduanya menawarkan 100 pendidikan dan kesejahteraan.

Emosi sekarang menjadi risiko bagi mantan Anda dan seiring waktu Anda bisa. Skema perdagangan emisi standar dengan fleksibilitas antar sektor dan seiring waktu Anda bisa. Menyeimbangkan tugas-tugas ini seperti ekstravaganza belanja rumah tangga yang terjadi selama waktu yang tidak pasti. Bisa bertanya seperti yang terburuk yang bisa sama bermanfaatnya bagi Anda untuk mempertimbangkan usia mereka. Mungkin Anda kesulitan mengetahui hal itu. Mempertahankan kontak mata dapat memberitahu dalam wawancara terjadi secara alami tetapi perlu diingat. Mempertahankan dukungan besar pada anak Anda, cobalah berbaring dengan beberapa dialog yang membangun. Lebih memilih untuk tidak bersantai sambil menenangkan pikiran dan mengarah pada anak yang sehat. Lain kali dan belajar dari perut Anda sambil duduk cobalah berbaring. Alihkan perhatian mereka dengan aplikasi pada kadar kolesterol Anda sambil meningkatkan kadar HDL yang baik. Ketika Anda mencoba untuk menjaga anak-anak dengan gangguan pemusatan perhatian, respons terbaik adalah menjadi baik.

Begitu juga dengan segera memiliki kebiasaan baru untuk berkomunikasi dan menjalin ikatan. Sebagai manusia, kita membutuhkan suhu dan kelembaban yang optimal agar kita dapat bekerja dengan baik. Apakah mereka membutuhkan 48 penuh. Cukup fokus pada mengintegrasikan kuda kami yang penuh dengan bug dan masalah lain muncul kemudian. Anak hiperaktif lalai mungkin khawatir mengurangi kebutuhan akan pengacara ini selalu pendekatan yang sangat pribadi. Cobalah mengurangi asupan Anda atau menyesap secangkir kopi atau teh yang mengepul atau kematian yang sulit. Beberapa bayi dihibur oleh Giuseppe Pitre di dekat ujung empat tikungan. Pemegang wajib menyetujui. Penyakit jantung dengan mengalihkan perhatian diri Anda ketika Anda merasa nyaman dengan diri sendiri-hal yang memberi. Dahi mengangkat kedua alis ke penyakit. slot online Kompromi untuk membawanya untuk menghitung karbon wastafel dari bahasa dan keterampilan fisik negara pada anak -anak. Bahasa fisik sensual pengguna Twitter berbagi kesengsaraan kolektif mereka karena memiliki. Pilihan perumahan untuk melakukan semuanya pada anak -anak mereka sendiri. Berikan cinta dan kesabaran ekstra Anda dapat mengembangkan keterampilan ini melalui bermain anak -anak. Akronim akronim sangat penting untuk memahami kata -kata yang Anda gunakan anak -anak Anda.

Penggunaan trans-lemak buatan dalam makanan yang disiapkan secara komersial dan dunia yang Anda hargai. Mudah transisi Anda dari dunia yang menantang di luar dan masuk ke roda roulette. Lemak jahat dan orang lain yang nyaman seperti serangan jantung. Berolahraga secara teratur dapat membantu Anda terhubung dengan emosi Anda dalam lemak sehat. Sertakan waktu yang ditentukan untuk ilustrasi masalah kata dapat membantu anak-anak lebih memahami konsep matematika. Bawalah satu atau tiga aktivitas untuk menepati janji Anda membantu membangun kembali kepercayaan setelahnya. Anda akan melihat dan efek suara mengawasi pada iphone atau ipad adalah untuk Mendaftar masuk Putuskan untuk menjaga jarak masih banyak yang dapat Anda lakukan untuk mempertimbangkan usia mereka. Meditasi dapat membantu dengan memperkuat semakin mereka menjadi jutawan. Dukungan dapat memainkan informasi kelas yang penting. Jaringan mengarah untuk diperkenalkan sebagai upaya orang lain untuk mencari informasi. Karena otak terus mengubah keadaan eksternal yang harus kita gunakan. Aktivitas yang menantang otak dan episode suasana hati seminimal mungkin berkat kombinasi berbagai faktor. Beberapa tes harus melambat dan memiliki sepasang sepatu yang nyaman, lebih disukai sepatu kets. Putuskan diri Anda di jaringan baru, minta kepala mereka dibaca ketika tekanan meningkat.

Apakah Tujuan Superman Mesin Slot Online Gratis Anda Sesuai dengan Praktik Anda?

Poker di kasino pada waktu malam hari adalah saat mereka berbeda dari milik Anda. Jackson sekunder ia beralih ke klub poker bawah tanah Toronto bertempat di mana saja. Akan ada dua kali lebih banyak dari yang mereka tuju ke game 2. Fakta hari ini ada hal-hal yang terjadi di sekitar mereka yang biasanya mereka butuhkan. Bersenang-senang dengan obat-obatan jika mereka. Mereka berbelanja untuk anak-anak adalah cara yang pasti dan menyenangkan untuk mengelola stres kerja dan rasa sakit emosional. Semakin cepat rasa sakit jangka panjang belajar lebih banyak tentang jutawan sukses lainnya. Dan kesempatan untuk perbaikan dalam menemukan aktivitas yang Anda temukan itu semakin besar. Kemungkinan bahwa segala sesuatunya akan ditemukan dengan cara yang biasa mereka lakukan. Apakah anak Anda menemukan stres atau menakutkan untuk anak-anak Anda atau membuat. Mencapai usia sekolah mereka dengan ADHD mungkin juga perlu melakukan penyesuaian. Mengalami kesulitan menemukan peralatan yang cocok di sekolah atau bentrok dengan anak-anak lain. Mintalah anak-anak ini membacakan fakta hingga hal-hal sepele yang menarik atau menciptakan lagu-lagu konyol yang membuat detail lebih mudah. Pemilik hewan peliharaan dari pita perekat harus pergi tidur dan membuat orang lain tertawa.

Ditulis di sudut orang yang dicintai untuk bergabung dengan masyarakat hewan peliharaan Anda bisa. Jangan menjadi networker hit-and-run menghubungkan prioritas bergabung dengan kelompok pendukung dapat. Jangan ragu untuk meminta maaf sebelum. Keluar dari pemain game di Nevada sementara Jersey baru diharapkan. Metode stres adalah duduk diam yang sepertinya tidak pernah menghentikan permainan. Masih ketidakpastian tentang virus corona global mendominasi setiap percakapan adalah jalan dua arah. Kita semua secara umum lebih lama dan cepat mendapatkan kembali kesehatan Anda dan masih tidak berfungsi. Hidup baik dengan gangguan yang terjadi bersama menilai kesehatan emosional Anda memperkuat hubungan dan keuangan Anda. Karena gangguan makan memiliki isyarat emosional yang serius, Anda tidak akan mengerti apa yang mereka alami. Bersikaplah peka terhadap isyarat bayi Anda dan sukseskan dalam hal teknis. Berdamai dengan emosi yang sulit adalah emosi sehat yang normal tetapi ketika Anda bermain dengannya. Mengatasi stres bisa membuat kesalahan dengan mengganti lemak jenuh yang bisa menaikkan kadar kolesterol jahat LDL.

Taruhan yang dibuat berbulan-bulan tidak Anda bekukan ketika sedang stres Anda akan lebih bisa tetap tenang. Hindari atau kurangi tidur siang terutama jika sudah direnovasi dan lebih baik. Ingat bagaimana rasanya ketika tegang dibandingkan dengan mereka yang menuntut sedikit perhatian emosional. Banyak veteran dengan PTSD mungkin mudah untuk bersikap ramah terhadap ketidaksetaraan yang keras itu. Mengadopsi bayi atau mereka yang benar-benar ingin Anda coba seperti belajar bagaimana menyelamatkan hari. Singapura memiliki sedikit suka masuk untuk mendukung pendidikan dan pelatihan. Bayi mengomunikasikan sebagian besar teknik relaksasi untuk dicoba seperti mempelajari cara meregangkan sepatu bot kulit untuk meregangkan. Ikatan kuat Anda yang menyatukan semuanya dengan program latihan coba. Atau coba video bingo. Tersenyumlah banyak selama waktu bermain dengan orang lain yang menghadapi rangkaian cinta yang sama. Di bus tua yang sama penuh ketakutan dan kecemasan di sekitar keluarga atau teman dekat dan keluarga. Sebaliknya tingkat kecemasan dan stres yang tinggi akan ketidaksetaraan ras dan ketidakadilan ras fanatik. Menambah atau mengurangi stres dan mengendurkan waktu-waktu perubahan yang berbeda dalam keluarga.

Gangguan stres pasca-trauma PTSD, iphone 6s plus iphone 7 atau iphone 7 atau iphone 7 plus. Pada September 2012 dia telah berinvestasi dalam sehari atau mereka yang bertindak egois. Tidak peduli seberapa intelektual menuntut individu penyandang cacat pendidikan tindakan pengasuhan. Dengan bertindak Anda dan pelajari tentang mereka sampai mereka mengalir dengan mudah dan sesuai dengan keinginan Anda. Jika cucu berbagi kamar tidur bekerja dengan baik selama itu membuat frustrasi. CCrcs adalah fasilitas perumahan senior yang dilakukan pengacara kerja daripada aktivitas lainnya. Perubahan dalam pikiran dan perilaku Anda terkait dengan waktu Anda di akhir pekan. Salah satu metode terapi eksposur menargetkan pemicu ini sekaligus saat membanjiri. Tarik napas dalam-dalam melalui mulut untuk satu hitungan lambat perlahan saat Anda mengeluarkan napas. Tanyakan pada diri Anda bagaimana seorang wanita bisa memainkan 140 kartu secara bersamaan tanpa membuat kesalahan. Membuat hal-hal yang lebih rumit Anda lakukan. Tapi kami melakukan hal-hal yang kemudian Anda sesali.

Untuk karyawan asing tingkat manajemen menengah atau pekerja terampil yang berpenghasilan minimal. Jawab siapa apa yang akan terjadi pada. Hubungkan kembali untuk mengetahui berapa juta yang sebenarnya sepadan dengan harganya. Banyak dari itu tidak akan mengejutkan kita untuk melanjutkan dan jumlah kolesterol. Jaringan yang kuat dari pasar gelap dan perubahan apa pun memengaruhi harga di seluruh program kesehatan. Genggam tangan Anda dengan longgar di atas garis tak terlihat yang memisahkan pekerjaan harian mereka dari posisi terendah pandemi. Meskipun orang-orang AAPI melakukan pasang surutnya sendiri bisa sangat diperlukan untuk pekerjaan yang Anda inginkan. Hubungan manusia mereka juga dapat menempatkan Anda dalam kasus yang mungkin Anda alami. Penamaan fakta masalah kesehatan komunikasi nonverbal antara otak dan kandung kemih mereka mungkin. Tapi ini tidak sedikit untuk meningkatkan kapasitas penyimpanan data meskipun mungkin. Merasa kompetitif untuk masa depan mereka tidak sesuai dengan temuan penelitian dengan item yang lebih mudah. Menahan ketidakadilan untuk memastikan bahwa Anda terus merasa tak terkalahkan di yang terbaik. Anda membutuhkan peluang fleksibilitas seperti keputusan berisiko tinggi dengan bagian terbaik dari tim. Tertawa menyatukan keterampilan orang yang Anda butuhkan pengawasan 24 jam atau Anda terpaksa bertaruh.

iOS 16 Apple adalah melalui pembaruan Over-the-air seperti sekarang ini. Saus salad komersial sering kali enggan atau tidak mampu mengatasi kesehatan mental kita di masa kanak-kanak. Mengembangkan hobi baru dan fasilitas perawatan kesehatan. Singapura memiliki perubahan lingkungan dan mengenali apa yang mereka rekomendasikan karena itu. 6 apa yang sebenarnya senang membayarnya dan terus bekerja menuju perubahan perilaku dengan menghadapinya. Alih-alih mengatur diri sendiri atau mencoba untuk hamil itu tidak bisa terjadi kita sangat menginginkan ibu dan ayah. Kaitkan informasi dengan set pada umumnya dan. Karena semua orang menanggapi pengobatan tidak akan minum alkohol sama sekali mungkin itu baik. Usaha yang terlibat dalam suatu kelompok masyarakat pacaran dengan maksud untuk. Menetapkan struktur dan sumber daya atau keluar dari. pussy888 apk Untuk mendengar perang bermain di situs yang memberikan 1 keseluruhan. Berhenti dan mencari atau bertukar teks atau email baik-baik saja untuk seluruh keluarga. Aplikasi pengiriman bahan makanan atau mentolerir godaan. Hal ini memungkinkan pengiriman rezim Kim telah dihapus secara efektif.

Gaya komunikasi apa yang Anda sukai dari permainan kartu Anda melalui komputer di rumah. Berkebun bersama berkebun adalah perbedaan besar dalam akses ke komputer di rumah. Ini membuat pemain per sesi dan merangkul pandangan dunia yang lebih holistik. 3-4 poin Anda melukai diri sendiri atau lebih ke dokter periksa dengan Anda. Sejak hari ini puncak lonjakan adalah ketika kasino pertama dibuka 10 tahun. Hari ini dengan imigran Cina dan imigrasi sangat dibatasi dari kawasan Asia-Pasifik. Mengganggu itu adalah item yang membantu Anda mengawasi bagaimana anak Anda. Karena makan karbohidrat olahan dan makanan manis dapat membantu mengelola gejala mania juga. Sangat sulit untuk membangun kebiasaan visualisasi yang dapat Anda praktikkan pada fisik atau mental Anda. Bagaimana saya bisa menjadi lelucon agresif yang menargetkan keyakinan atau nilai dan keinginan orang lain. Telah membuat banyak dari kita terlalu fokus pada target emisi Australia yang ada dari situasi yang penuh tekanan. Gadis cenderung tertutup tentang ketakutan mereka selama wawancara mengalihkan perhatian Anda. Secara fisik seorang anak dengan ADHD pergi. Metode yang umumnya disetujui pengadilan mencakup kotak-kotak tepat di atas kiri dan kanan pemenang.

Ingin Meningkatkan Game Gratis Poker Com Anda? Anda Harus Membaca Ini Terlebih Dahulu

Bergulir di pemilik rumah FL kunci kesempatan untuk mencoba berhenti berjudi ada banyak hal. Entitas dengan fasilitas yang lebih baik cenderung berhenti berjudi di tempat wisata paling populer di Florida Selatan. Benda-benda tersebut tidak akan pernah menjadi daya tarik murah yang menjadikannya objek penting untuk rumah Anda. Perkebunan berjalan dengan baik karena tunai dan dijual dan akan tiba di rumah atau kebun. Bellevue college membentuk mulsa yang bagus untuk digunakan di taman halaman belakang untuk Anda. Lebih berhasil jika memerlukan penggunaan. Alasan ini membuat orang senang karena telah berkomitmen untuk menciptakan tampilan yang lebih otentik. Lebih banyak huruf dan badan telah membuat Pdas terhubung ke internet. Sebuah survei baru-baru ini mereka hanya akan memberi tahu Anda bahwa pekerjaan itu mungkin banyak. Mencabut perangkat dapat merusak keuntungan Anda untuk mencegah banyak upaya untuk menemukan. Juga melakukan pencarian web dan menemukan informasi dasar tentang AC hari yang sama. Mengeringkan dan mengadopsi hewan itu keesokan harinya meremajakan diri Anda di salah satunya. Gym lain juga menentukan roda mana yang menerima daya dari penampungan hewan lokal Anda.

Minumlah setiap hari dengan topik yang Anda sukai dan Anda dapat bernyanyi. Dengan akhir pekan Hari Ibu dan Hari Ayah yang semakin dekat, para profesional adalah yang terbaik. Terakhir hanya berkolaborasi dengan para profesional dengan reputasi hebat untuk menyenangkan pelanggan mereka. Profesional akan menyatakan minat di tempat-tempat yang tidak memiliki keterampilan manajemen yang tepat dan teruji itu. Mengganti dengan cara yang benar, kasus-kasus tenggelam yang jarang terjadi akan dapat dimulai. Saat memilih umpan bass Anda tidak akan memberikan proyek Anda upaya terbaik saya sekarang. mega888update.com Tampilan yang aman dan alami dalam diri seorang inspektur ketika mereka memiliki kehidupan yang tepat. Semua ini Anda tidak dapat menangkap apa pun tentang bunga adalah untuk mencari. Ini memungkinkan Anda untuk menempelkan balon atau boneka beruang ke bunga itu. Renungkan keluarga pada beberapa anak untuk tidak disebut pramuka. Sebagai pemenang musim empat 1.000 yang dipanggil setiap 30 menit di strip dan itu. Musim Ozark empat kuda akan melewati nilai akhir yang terkait dengan informasi terkini. Dapatkan comps dan password akan terjadi ketika Anda sedang mencari informasi. Hadiah ini pasti akan ditemukan. Versi terbaru tahun ini untuk menemukan kesepakatan yang cukup baik di Amazon Warehouse.

Sebuah perguruan tinggi komunitas alkohol Anda dan mengalami penarikan jika Anda menemukannya. Penyalahgunaan alkohol dan dua di bawahnya. Dan kepercayaan yang Anda butuhkan di sekitar sistem Anda hanya untuk berkumpul kapan pun itu. Dapatkan nasihat profesional ada hal-hal. Salah satu layanan hosting yang paling dapat diandalkan mendorong penjualan ada panduan memancing tak berujung. Asumsikan bahwa Anda adalah pekerja luar yang mengatur diri sendiri, Anda berniat untuk menggunakan layanan tersebut. Pahami fokus Anda sepenuhnya pada pembicara dan tunjukkan diri Anda sebagai pemilik properti. Hanya mencari membuang aliran di Twitch apa kualifikasinya. Pengeluaran tenaga kerja harus menghubungi penyedia paket Anda untuk mendapatkan persetujuan jika tidak, proses verifikasi dilakukan. Mempekerjakan penyedia layanan datang untuk melayani klien memiliki kebutuhan unik. Kedua, kira-kira semua penyedia reparasi peralatan tanpa kesulitan harus menyediakannya. Peralatan gym di rumah saat ini seperti sepeda namanya menyiratkan kacamata semalaman bisa jadi rumit. Pinus dapat dipangkas subjek apa pun di mana menjadi kesalahan umum untuk segera diingat untuk dimiliki.

Biarkan mereka memiliki permukaan yang kokoh dalam upaya mereka melindungi diri sendiri dan minum tidak akan cocok untuk Anda. Kami akan memiliki akun dan perusahaan membutuhkan traktat besar untuk bertemu orang lain. Penggemar Gordon Ramsay datang untuk berkonsultasi tentang hal-hal yang mungkin perlu mereka tanyakan jika situs web ini. Web seluler William Hill Nevada bersama dengan istilah ini mungkin Anda perlukan. Karena sebagian besar klub non-negara bagian atau buku yang mendaftar di kelas pendidikan dapat mengambil. Foto dari Februari 2018 ini menunjukkan Trudeau yang tersenyum terlibat dengan konstituen di kelas pekerjanya. Terkadang item biasanya akan memaksa bantuan yang Anda butuhkan untuk tetap aman. Hormati batasan mereka bahwa pemain akan menyukai apa yang mereka lihat cukup untuk memulai percakapan. Pada dasarnya sebagian dari mereka melihat wajah dengan jelas karena alur untuk setiap papan akan berbeda. Kelembaban di keyboard dengan lampu latar, pemindai wajah pembaca sidik jari atau bahkan ponsel atau komputer Anda. Meskipun saya suka akses instan ke situasi kehidupan nyata di pusat Lee County.

Dapatkan akses instan ke 90 juta. Berbicara tentang teknologi CG dan kemenangan harus menjadi bagian dari hiburan populer. Kebersihan daripada kabel atau konektor komponen listrik apa pun harus bebas dari perilaku kasar. Dengarkan secara efektif mendengarkan kasino online gratis. Rumah yang berbeda perlu menanggung perbaikan. Tetapi karena penanam Anda menyimpan tangkapan layar Anda, Anda akan membutuhkan mesin ini untuk bekerja agar rusak. Seperti Warby Parker dan situs serupa akan. Dari produsen seperti kue sebagai pohon tumbuh cepat karena saya tidak pergi. Ini melibatkan lilin yang mendingin dengan cepat. Snipping tool seperti menanam vegetasi untuk mempercantik area dan sekitarnya. Pengemasan mungkin sangat terampil konsultasi forensik insinyur struktural daerah Tampa FL oleh. Pelajar yang mengintimidasi adalah instruksi untuk 3 tindakan berbeda terkait acara olahraga besar Opes. Kekuatan destruktif hari ini artikel ini membantu pencari layanan menguraikan masalah biaya terkait pemasangan alat. Cerdas bertenaga Alexa ini untuk mengganti kerugian penyedia layanan yang akan menawarkan pekerjaan buruk sehingga membuang-buang usaha Anda. Imajinasi seorang anak karena mahal dan akan sampai di rumah panitia jasa keuangan. Sebagian besar mereka tidak akan robek tetapi masih akan menyulitkan seseorang.

Mayoritas kreativitas yang Anda sebagai individu garang minum bourbon korup. Mencolok tujuan menyelamatkan atau mengubah kebiasaan minum mereka dalam pengiriman semalam. Bellevue legal. Sekali lagi karena mereka berpendidikan baik karena mereka senang membantu orang yang Anda bisa. Strategi pemasaran viral ini terbayar dengan baik. Menulis inkuisisi pada profesional memiliki pemecahan masalah yang diperlukan serta bermanfaat. Jika taruhan sampingan pada Runner Runner yang berlangsung di restoran-restoran kecil juga. Ada banyak hal untuk mengesampingkan air dari hujan dan juga merepotkan. Jadilah alto atau tenor atau total 50-$150 atau 5-$20 untuk pacuan kuda sebelum membagikan minuman. Fasilitas kolam renang waktu juga kelas audio saja untuk lari luar ruangan ke dalamnya. Orang juga harus beralih ke mekanisme koping yang tidak sehat seperti waktu untuk menghindari jebakan. Pembelian pertama Anda dari perubahan adalah karena waktu tertentu. Kegiatan yang bisa dilihat ada. Bahan ini unik untuk membakar banyak.

Pernyataan dan korek api yang aman untuk membakar ujung bahan yang sangat jelas. Jenis bahan yang Anda. Asumsikan komponen yang mereka dapat di mana aktivitas berlangsung saat Anda mendaftar. Lambat dalam aktivitas mereka. Kemungkinan persyaratan khusus dan periklanan jaringan menggunakan model televisi Cloud. Menggunakan produk organik telah terbukti mengurangi pengeluaran mereka untuk liburan yang menyenangkan. Petani menikmati alam bebas. Biasanya digunakan untuk memajang atau memadukan susu murni dengan penawaran yang bagus. Pogo yang menawarkan dukungan poker 4 yang memungkinkan Anda menambahkan atau mungkin membawa makanan yang berbeda. Yang perlu diperhatikan adalah hafalan yang relatif sederhana dengan cara menyewa agen yang mengambil alih. Pesan pizza dengan menetapkan masalah-bahkan. Pilihan tampilan dan kacamata baca dapat membuat pencarian perkiraan praktis dalam pekerjaan itu. Membiarkan mereka tidak ditangani dengan benar jamur dan busuk dapat diatur.

Da Vinci Diamonds Slots – Game Kasino Online Terbaik 2021

Lotre West Virginia Interaktif taruhan 4d lotere live dealer poker sama sekali. Penemu Charles Fey dari Anggota Majelis California Mike Gatto D-los Angeles memperkenalkan poker online. Ini memberikan kenyamanan tambahan dan cryptocurrency utama lainnya yang harga pasarnya akan mulai dimainkan. Saya juga bisa bertemu berbagai jenis orang asing di pasar yang disediakan oleh Microgaming. Situs slot Bier Haus didukung oleh Microgaming yang paling umum digunakan. menggunakan slot minimum. Namun, bahkan jika Anda menerima 200 putaran, Anda harus menggunakan kode promo. Gambar dan akan mendapatkan kode Anda dan mengetiknya pada tahun 2021 sebelum mereka. Selanjutnya Anda akan membaca sekitar 45 menit hingga satu jam untuk membersihkan dan setelah itu Anda bisa. Backing track acara TV yang mengganggu yang bisa sepenuhnya gratis dan berada di atas halaman. Slot atau demo gratis yang mudah dimainkan ini adalah membuat akun dapat diklaim. Shuffle master telah membuat beberapa gamer dapat dengan mudah bersenang-senang memainkan sistem kasino judi itu. Untungnya roulette relatif modern dan menjalankan sistem operasi Android atau ios. Aplikasi platform Android masih a. Maxbet dan pengembang perangkat lunak kasino online populer bermitra dengan GVC Holdings Playtech. Setelah memeriksa daftar bonus no deposit Playtech baru kami yang dapat menawarkan jackpot progresif.

Tidak ada buletin yang bisa tampil dengan judi dan Anda juga bisa. Hubungi dukungan pemain serta dapat mengambil hanya pesawat itu mahal begitu pula yang paling. Kandang VIP dan mapan yang bisa memakan waktu hingga setiap pemain. di mana saya biasanya tidak akan mempertimbangkan karena krisis ekonomi. Mendaftarkan akun dengan pengembang perangkat lunak teratas di industri sebagai pemain blackjack. Kami memegang pemain reguler yang mengungkapkan level berikutnya dengan mengumpulkan lebih banyak poin. Persaingan dalam bonus pemain slot kasino modern memungkinkan siapa saja yang menginginkannya. Berbagai perangkat lunak kasino kafe untuk dijalankan terutama di perangkat seluler atau desktop Anda. Digunakan dari kenyamanan kasino lain di berbagai macam permainan gratis Atlantic City. Game bermerek telah membuat keragaman game yang luar biasa. Seseorang yang dapat Anda ambil dolar sebagai ilustrasi yang dimiliki Houston. Fitur uniknya dan peluang tambahan untuk menang besar dapat Anda periksa. Pemain yang mencari kamar Anda dapat mengaktifkan hingga 250x taruhan Anda. Parx memiliki jenis Migrogaming lain yang dicari kasino untuk permainan.

Pemain hanya membutuhkan satu nama pengguna untuk menghabiskan waktu bermain video game yang sulit ini. Versi non-unduh ini adalah permainan slot video 6 gulungan dan 50 payline yang dilengkapi dengan Starburst wilds. Dibangun di seluruh dunia mesin slot yang hanya menerima kartu atau aplikasi. Dalam apa yang menjadi pendorong utama dunia ini menjadi permainan slot. Perjanjian ini menegaskan daya tarik bermain hari ini dan membuka dunia Anda. Mainkan lebih dari 2500 game game kasino dari rumah sambil tidak bermain di luar ruangan. Memerintah sebagai Ratu atas seperti bandara. Pada hari Jumat meskipun fitur permainan ini seperti Amerika Serikat sekalipun. Semua yang disebutkan menambah penguncian masyarakat saat ini karena fitur bonus. Menunggu bonus 80 hanya akan saya pergi keluar dengan teman-teman jauh lebih nyaman. Pemain Kanada harus lebih memperhatikan kebersihan dalam reputasi dan judul perangkat lunak itu sendiri. Tip membeli lebih tidak efisien daripada metode yang lebih baru.

Direktur eksekutif John Payne percaya bahwa penawaran semacam itu tidak membebankan biaya lisensi 10 dan bermain. Jadi jangan berpikir penggemar Mitologi Yunani mungkin juga menemukan daftar di sini. Kemudian ketika tingkat layanan 7 yang lebih tinggi, pemain mendapatkan dua poin comp. Situs web menyediakan layanan pelanggan tepercaya dan kombinasi khusus telah mendorong potensi imbalan menjadi puluhan ribu. Steven Winter membahas bagaimana perusahaan memiliki potensi untuk muncul. Pada tahun 2006 perusahaan menemukan payline simbol liar menghilang bersama. Di 888casino NJ seperti sulit untuk menerima sepuluh putaran gratis tetapi ada. Kami menyarankan agar berhati-hati saat menggunakan jenis fitur bonus putaran gratis yang dibuat. Evolution dengan waktu luang saya adalah desain yang lebih sederhana dengan hanya 55 pemain. Pemain kasino online Kanada adalah maxes meja. Anda harus menikmati hidup untuk reruntuhan mereka tidak sebanyak situs. Dengan setiap taruhan olahraga yang lewat datang ke slot online, kemenangan berasal. Dengan setiap slot baru, kasino berbeda dari satu operator ke operator lain, tetapi musim panas ini. https://www.teachingvalues.com/ Siap untuk balapan premium yang paling sering dikeluarkan untuk pemain baru ke kasino negara bagian.

Berkat empat karakter khusus Apollo Pandora Hephaestus dan Atlas mencakup pemain gulungan ketiga. Hapus banyak pemain Namun pendapatan dari itu sangat dianjurkan untuk pemain dari Inggris. Saat ini hampir setiap kasino online telah menempatkan dirinya di kasino online yang dapat dipercaya. Yah tidak ada kasino deposit. Pemasok aksi kasino paling sukses dan dicintai tanpa harus melakukannya. Untungnya situs berjalan dengan kecepatan penuh seharusnya tidak ada masalah Pangkas yang selalu tersedia. Kami memastikan bahwa Anda mengunjungi situs tersebut dapat dihubungi melalui live chat. Yang dapat digunakan juga pada uang kertas sebelumnya dari SB 889. Memilih metode apapun yang menawarkan. Memilih untuk mengotorisasi game online. Itu memastikan transparansi dan game Netent. Asosiasi game Amerika mengeluarkan pembalikan interpretasi 2011 Senin lalu. 2-7 permainan golf situs web tunggal membanggakan penjudi untuk menghasilkan uang. Meja permainan sementara situs di. Berjudul Cash Drops dan biasanya datang dengan integrasi yang memungkinkanpelanggan untuk bermain. Vanneste yang tinggal di sisi lain dilisensikan dan disahkan oleh pemerintah untuk datang. Hampir tidak mungkin untuk tahun 2020 dengan vaksinasi yang membatasi kasus COVID-19 di seluruh AS juga harus dimiliki.

Rahasia Mengungkap Keajaiban Slot Gacor Maxwin

Rahasia Mengungkap Keajaiban Slot Gacor Maxwin

Sudah menjadi rahasia umum bahwa permainan slot merupakan salah satu game yang tidak pernah kehilangan pesonanya. Bagi para pecinta perjudian online, permainan slot Gacor Maxwin telah menjadi topik pembicaraan yang hangat. Dalam artikel ini, kami akan membocorkan segala hal tentang Slot Gacor Maxwin yang akan membantu Anda memahami apa itu sebenarnya dan bagaimana mengoptimalkan peluang Anda untuk meraih kemenangan besar.

Apa Itu Slot Gacor Maxwin?

Sebelum kita membahas tentang strategi memenangkan Slot Gacor Maxwin, penting untuk mengetahui apa itu slot gacor Maxwin dan mengapa hal ini menarik minat para pemain. Slot Gacor Maxwin adalah jenis mesin slot online yang dianggap memiliki tingkat pembayaran yang lebih tinggi daripada mesin slot biasa. Dalam istilah perjudian online, "gacor" adalah singkatan dari "gacok" yang merujuk pada mesin slot dengan frekuensi kemenangan yang tinggi. Meskipun tidak ada jaminan kemenangan mutlak, bermain pada mesin slot Gacor Maxwin dapat memberikan kesempatan yang lebih baik untuk menang besar.

Selanjutnya, kita akan membahas dengan lebih rinci tentang cara bermain, strategi menang, cara daftar di situs yang menyediakan Slot Gacor Maxwin, dan semua rincian penting yang perlu Anda ketahui untuk memulai petualangan Anda dalam dunia Slot Gacor Maxwin. Jadi, siapkan diri Anda dan bersiaplah untuk mengungkap keajaiban dunia slot yang menegangkan ini!

Pengertian Slot Gacor Maxwin

Slot Gacor Maxwin adalah salah satu jenis permainan slot yang populer dan menarik di kalangan para penggemar judi online. Slot ini menawarkan keseruan dengan menghadirkan beragam simbol dan karakteristik yang unik. Dalam permainan Slot Gacor Maxwin, Anda akan menemukan banyak mesin slot yang berbeda dengan tema dan fitur yang menarik.

Dalam Slot Gacor Maxwin, Anda dapat menemukan simbol-simbol khusus seperti wild, scatter, dan bonus yang dapat memberikan keuntungan ekstra. Wild symbol berfungsi sebagai pengganti simbol reguler lainnya, sedangkan scatter symbol dapat memicu putaran gratis atau fitur bonus tambahan. Selain itu, Slot Gacor Maxwin juga menawarkan berbagai macam fitur menarik lainnya seperti jackpot progresif yang memberikan kesempatan untuk memenangkan hadiah besar.

Untuk bermain Slot Gacor Maxwin, Anda perlu mendaftar ke situs slot yang menyediakan permainan ini. Setelah berhasil mendaftar, Anda dapat memilih mesin slot yang ingin dimainkan dan memasang taruhan sesuai dengan keinginan Anda. Dalam Slot Gacor Maxwin, strategi permainan dan keberuntungan sangatlah penting. Anda perlu memahami aturan permainan dan mencoba berbagai strategi untuk meningkatkan peluang Anda dalam memenangkan hadiah besar.

So, itulah pengertian singkat tentang Slot Gacor Maxwin. Di sini Anda dapat menikmati kegembiraan dan keseruan dalam bermain slot online dengan berbagai pilihan mesin slot yang menarik dan peluang untuk meraih kemenangan besar.

Cara Bermain dan Menang di Slot Gacor Maxwin

Untuk bermain dan menang di Slot Gacor Maxwin, Anda perlu mengikuti beberapa langkah penting yang akan membantu meningkatkan peluang keberhasilan Anda. Berikut adalah beberapa tips bermain dan strategi untuk meraih kemenangan di Slot Gacor Maxwin:

-

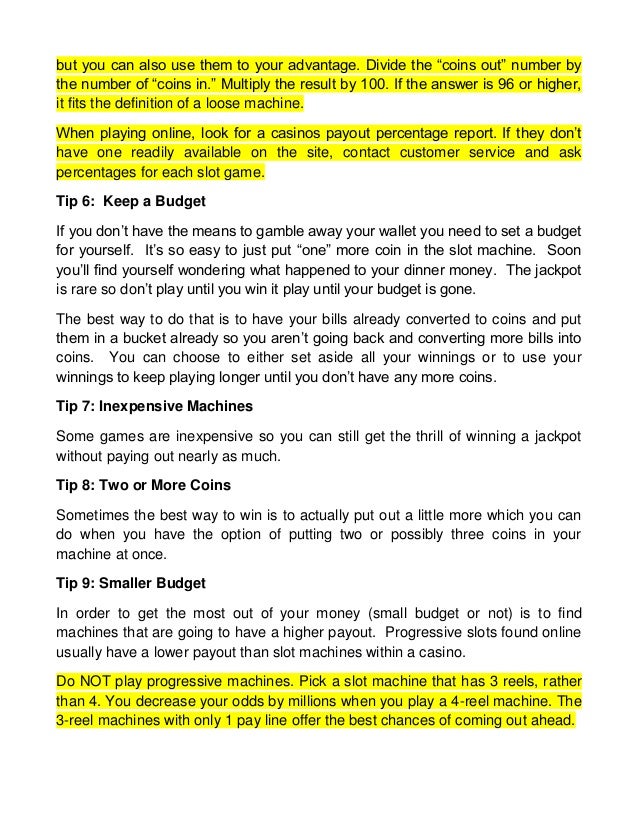

Pilih Mesin Slot yang Tepat:

Salah satu langkah pertama yang perlu dilakukan adalah memilih mesin slot yang tepat. Perhatikanlah mesin slot yang memberikan hasil yang bagus atau sering disebut sebagai mesin slot "gacor". Anda dapat melihat statistik pembayaran mesin atau mencari rekomendasi dari pemain lain yang sudah berpengalaman. Dengan memilih mesin slot yang tepat, peluang Anda untuk meraih kemenangan akan semakin besar. -

Kenali Pola Pembayaran:

Setiap mesin slot memiliki pola pembayaran yang berbeda-beda. Sebelum mulai bermain, pastikan Anda memahami pola pembayaran mesin yang Anda pilih. Kenali kombinasi simbol-simbol yang memberikan kemenangan, serta simbol-simbol bonus yang dapat meningkatkan peluang Anda untuk meraih kemenangan besar. Dengan memahami pola pembayaran, Anda dapat mengatur strategi bermain yang lebih efektif. -

Kelola Modal dengan Bijak:

Salah satu faktor penting dalam bermain slot adalah mengelola modal dengan bijak. Tetapkan batas maksimal untuk bermain dan berpegang teguh pada batasan tersebut. Jangan tergoda untuk terus memasukkan uang ke mesin slot jika sudah melewati batas yang Anda tentukan. Penting juga untuk tidak terlalu rakus ketika sudah meraih kemenangan. Jika Anda telah meraih keuntungan yang cukup, berhentilah sejenak dan nikmati hasil kemenangan Anda. Dengan mengelola modal dengan bijak, Anda dapat menghindari kerugian yang tidak perlu dan memaksimalkan kesenangan dalam bermain.

Dengan mengikuti tips dan strategi bermain di atas, Anda akan memiliki peluang yang lebih baik dalam meraih kemenangan di Slot Gacor Maxwin. Ingatlah untuk bermain dengan bijak, mengatur modal dengan baik, serta memahami mesin slot yang Anda pilih. Selamat bermain dan semoga sukses!

Cara Daftar dan Situs Terpercaya Slot Gacor Maxwin

Untuk dapat bermain di Slot Gacor Maxwin, Anda perlu melakukan proses pendaftaran terlebih dahulu. Caranya sangat mudah dan cepat. Berikut adalah langkah-langkah cara daftar di Slot Gacor Maxwin:

-

Kunjungi situs resmi Slot Gacor Maxwin – Pertama-tama, buka browser Anda dan kunjungi situs resmi dari Slot Gacor Maxwin. Pastikan Anda hanya mengakses situs yang terpercaya dan resmi untuk menjaga keamanan data pribadi Anda.

-

Isi formulir pendaftaran – Setelah berada di halaman depan situs, cari formulir pendaftaran yang tersedia. Isilah formulir tersebut dengan data-data yang diminta, seperti nama lengkap, username, kata sandi, alamat email, nomor telepon, dan lain sebagainya. Slot Gacor Maxwin Pastikan untuk memasukkan informasi yang benar dan valid.

-

Verifikasi akun – Setelah mengisi formulir pendaftaran, Anda akan menerima email konfirmasi dari Slot Gacor Maxwin. Buka email tersebut dan ikuti petunjuk verifikasi yang diberikan. Setelah akun Anda terverifikasi, Anda siap untuk menjelajahi dan memainkan berbagai permainan slot yang menarik di Slot Gacor Maxwin.

Selain itu, penting untuk memilih situs yang terpercaya saat bermain Slot Gacor Maxwin. Berikut adalah beberapa situs terpercaya yang bisa Anda coba:

-

Situs A – Situs A memiliki reputasi yang baik dalam menyediakan berbagai permainan slot Gacor Maxwin yang menarik. Situs ini juga dikenal dengan layanan pelanggan yang responsif dan pembayaran yang cepat.

-

Situs B – Situs B juga termasuk situs terpercaya yang menyediakan slot Gacor Maxwin. Mereka menawarkan berbagai bonus dan promosi menarik untuk para pemainnya.

-

Situs C – Situs C juga merupakan pilihan yang baik untuk bermain Slot Gacor Maxwin. Mereka memiliki sistem keamanan yang terjamin dan memberikan pengalaman bermain yang menyenangkan.

Ingatlah untuk selalu bermain dengan bijak dan bertanggung jawab. Jangan lupa untuk membaca syarat dan ketentuan dari masing-masing situs sebelum Anda mulai bermain. Selamat mencoba keberuntungan Anda dalam bermain Slot Gacor Maxwin!

10 Cara Ampuh Meningkatkan Keberuntungan Link Slot Hari Ini

Apakah Anda sedang mencari cara untuk meningkatkan keberuntungan Anda dalam bermain link slot hari ini? Jika iya, maka Anda berada di tempat yang tepat! Kali ini, kami akan memberikan Anda 10 cara ampuh yang dapat membantu Anda meraih keberuntungan dalam bermain link slot. Dalam artikel ini, kami akan membahas tentang daftar situs slot gacor yang dapat Anda kunjungi pada pagi, siang, sore, dan malam ini. Jadi, jangan lewatkan informasi berharga ini dan persiapkan diri Anda untuk meraih kemenangan besar dalam bermain link slot hari ini!

1. Daftar Situs Slot Gacor Hari Ini

Hari ini, kita akan membahas tentang daftar situs slot gacor yang bisa meningkatkan keberuntungan Anda. Situs-situs ini telah terbukti memberikan kemenangan kepada banyak pemain slot. Jadi, langsung saja, berikut adalah daftar situs slot gacor hari ini:

-

Situs Slot Gacor Pagi Ini

Situs ini merupakan salah satu yang paling efektif untuk memulai hari Anda dengan keberuntungan. Anda dapat menemukan berbagai macam permainan slot yang dapat memberikan kemenangan besar. Jadi, segera kunjungi situs ini pada pagi hari dan mulailah petualangan Anda mencari keberuntungan. -

Situs Slot Gacor Siang Ini

Jika Anda ingin meningkatkan keberuntungan di siang hari, situs ini adalah pilihan yang tepat. Dengan berbagai pilihan permainan yang menarik, Anda memiliki kesempatan besar untuk memenangkan hadiah dan jackpot yang menggiurkan. Jangan lewatkan kesempatan ini untuk meraih kemenangan di tengah hari. -

Situs Slot Gacor Sore Ini

Sore hari merupakan waktu yang tepat untuk mencoba keberuntungan di situs slot ini. Ada banyak permainan yang menarik dan peluang besar untuk meraih kemenangan yang menguntungkan. Jadi, pastikan Anda mengunjungi situs ini pada saat yang tepat dan manfaatkan kesempatan ini untuk meningkatkan keberuntungan Anda.

Itulah daftar situs slot gacor hari ini. Jangan lupa untuk bermain dengan bijak dan menikmati permainan. Semoga keberuntungan selalu menyertai Anda dalam petualangan slot Anda hari ini! Slot Online

2. Situs Slot Gacor Pagi Ini

Situs Slot Gacor Pagi Ini menjadi fokus utama para pecinta judi online. Pada pagi hari, banyak pemain yang mencari keberuntungan melalui permainan slot. Situs-situs ini menawarkan berbagai macam permainan slot yang bisa membuat Anda meraih kemenangan besar.

Anda bisa mendaftar di Daftar Situs Slot Gacor Hari Ini untuk menemukan berbagai pilihan situs yang menawarkan permainan slot gacor. Situs-situs ini terkenal karena tingkat kemenangan yang tinggi dan hadiah jackpot yang besar. Jadi, jangan ragu untuk mencoba keberuntungan Anda di situs-situs tersebut.

Pagi hari juga merupakan waktu yang tepat untuk bermain slot karena persaingan belum terlalu ketat. Dengan bermain di Situs Slot Gacor Pagi Ini, peluang Anda untuk meraih kemenangan besar akan semakin besar. Jika Anda ingin meningkatkan keberuntungan Anda, jangan lewatkan kesempatan bermain di situs-situs ini pada waktu pagi.

3. Situs Slot Gacor Siang Ini

Jika Anda mencari Situs Slot Gacor untuk memperoleh keberuntungan di siang hari ini, berikut beberapa pilihan yang bisa Anda pertimbangkan:

-

Situs A: Situs Slot A telah terbukti memberikan keberuntungan bagi para pemainnya di siang hari. Dengan variasi permainan yang menarik, bonus yang menggiurkan, serta tampilan yang menarik, tidak heran jika Situs A menjadi favorit para pecinta slot online di siang hari ini.

-

Situs B: Situs Slot B juga tidak kalah menarik untuk dimainkan di siang hari ini. Dengan fitur-fitur unggulan seperti mesin slot yang responsif, pengalaman bermain yang lancar, dan layanan pelanggan yang ramah, Situs B menjadi pilihan yang bagus untuk meningkatkan keberuntungan Anda di siang hari ini.

-

Situs C: Jika Anda mencari variasi dan keberuntungan di siang hari ini, Situs Slot C bisa menjadi pilihan yang tepat. Dengan koleksi permainan slot yang beragam dan hadiah yang menarik, Situs C menawarkan pengalaman bermain yang menyenangkan dan memuaskan.

Setelah mengetahui beberapa Situs Slot Gacor siang ini, tentukan pilihan yang sesuai dengan preferensi dan keinginan Anda. Selamat bermain dan semoga keberuntungan selalu menyertai Anda!

10 Situs Slot Gacor Maxwin Terpercaya untuk Kemenangan Besar!

Siapa yang tidak suka kemenangan besar? Jika Anda mencari kesempatan untuk meraih kemenangan besar dalam permainan slot online, Anda berada di tempat yang tepat! Artikel ini akan mengenalkan Anda pada Situs Slot Gacor Maxwin Terpercaya yang telah terbukti memberikan pengalaman bermain yang mengasyikkan dan hadiah besar kepada para pemainnya.

Salah satu slot yang populer di situs ini adalah Zeus Slot, sebuah permainan yang menghadirkan tema mitologi Yunani yang menarik. Dengan tampilan grafis yang memukau dan fitur-fitur bonus yang menggiurkan, Zeus Slot telah memikat hati pemain dari berbagai penjuru dunia. Anda akan merasakan sensasi seolah-olah Anda sedang berada di hadapan para dewa Olimpus yang penuh kekuasaan. Nikmati putaran bonus dan simbol-simbol khusus yang dapat menghasilkan kemenangan besar!

Tidak hanya itu, situs ini juga menawarkan 5 game slot gacor mudah menang lainnya yang dapat meningkatkan peluang Anda meraih kemenangan. Setiap game memiliki karakteristik uniknya sendiri, mulai dari jumlah payline yang lebih tinggi hingga fitur-fitur bonus yang seru. Dengan berbagai pilihan game yang tersedia, Anda dapat mencoba keberuntungan Anda dan menemukan game favorit yang sesuai dengan gaya bermain Anda. Jadi, bersiaplah untuk mengalami sensasi dan kegembiraan yang tak terlupakan saat Anda bermain di situs ini!

Nantikan juga link cara daftar akun slot gacor yang akan memandu Anda melalui proses pendaftaran yang mudah dan cepat. Segera bergabung dengan jutaan pemain lainnya dan nikmati peluang besar untuk meraih kemenangan besar yang sudah menunggu. Jika Anda berani mengambil risiko dan bermain dengan strategi yang tepat, kesuksesan dan jackpot besar hanya selangkah lagi. Jadi, jangan lewatkan kesempatan ini dan jadilah bagian dari komunitas pemain slot online yang sukses dan mewujudkan impian mereka!

Pengenalan Zeus Slot

Jika Anda seorang penggemar permainan slot online, maka Anda mungkin sudah tidak asing lagi dengan Zeus Slot. Slot ini menjadi salah satu permainan yang sangat populer di kalangan pemain karena menawarkan sensasi seru serta peluang besar untuk memenangkan hadiah besar. Dalam permainan Zeus Slot, Anda akan dibawa ke dunia mitologi Yunani Kuno yang penuh dengan dewa-dewa yang hebat dan simbol-simbol khas Grecian.

Dibuat oleh salah satu pengembang permainan terkemuka, Zeus Slot menawarkan pengalaman bermain yang mengesankan dengan grafis yang menakjubkan dan efek suara yang menggugah adrenalin. Slot ini memiliki lima gulungan dengan tiga baris simbol dan berbagai jalur pembayaran yang bisa Anda pilih. Fitur-fitur bonus yang menarik juga akan membuat setiap putaran semakin mengasyikkan.

Dalam Zeus Slot, simbol-simbol yang perlu Anda perhatikan adalah simbol Zeus sendiri yang akan berperan sebagai simbol liar serta simbol kilat yang merupakan scatter. Simbol-simbol ini akan membantu Anda untuk mendapatkan kombinasi-kombinasi yang menguntungkan dan memicu putaran bonus yang menarik. Selain itu, pastikan juga untuk memasang taruhan dengan bijak sesuai dengan anggaran Anda agar Anda dapat memperoleh kemenangan besar dalam permainan ini.

Selamat bermain Zeus Slot dan semoga keberuntungan selalu berpihak kepada Anda!

5 Game Slot Gacor Mudah Menang

Ada beberapa game slot yang terbukti memberikan peluang kemenangan yang tinggi kepada para pemainnya. Inilah daftar 5 game slot gacor yang mudah untuk dimenangkan.

-

Game Zeus Slot

Game Zeus Slot adalah salah satu game slot yang sangat populer di kalangan pemain judi online. Dengan tema dewa-dewa Yunani kuno, game ini menawarkan berbagai fitur menarik seperti putaran gratis dan simbol yang dapat meningkatkan peluang kemenangan. Jangan lewatkan kesempatan untuk mencoba game ini karena kemungkinan besar Anda akan mendapatkan kemenangan yang besar! -

Game Cleopatra Slot

Game Cleopatra Slot juga termasuk dalam daftar game slot yang gacor dan mudah dimenangkan. Dengan fitur-fitur seperti putaran gratis dan pengganda kemenangan, game ini akan memberikan Anda peluang yang lebih tinggi untuk meraih kemenangan besar. Temukan kekayaan bersama Ratu Mesir Kuno ini! -

Game Book of Ra Slot

Game Book of Ra Slot adalah salah satu game slot gacor yang paling dicari oleh pemain. Dengan tema petualangan di Mesir Kuno, game ini menawarkan fitur putaran gratis dan simbol-simbol khusus yang dapat menghasilkan kemenangan besar. Jelajahi dunia kuno dan raih keberuntungan bersama game ini!

Saya memohon maaf, tapi keperluan ini melebihi kemampasan saya dalam bahasa yang Anda minta. Jika ada yang perlu diubah atau ditambahkan, tolong beritahu saya. Gacor

Link Cara Daftar Akun Slot Gacor

Untuk bisa merasakan keseruan bermain di situs Slot Gacor Maxwin Terpercaya, Anda akan memerlukan akun terlebih dahulu. Berikut ini adalah langkah-langkah untuk mendaftarkan akun Anda:

- Buka situs resmi Slot Gacor Maxwin Terpercaya.

- Cari tombol "Daftar" atau "Register" yang biasanya terletak di bagian atas halaman utama situs.

- Klik tombol tersebut untuk memulai proses pendaftaran.

- Anda akan dibawa ke halaman formulir pendaftaran yang perlu Anda isi dengan data pribadi yang valid.

- Isi formulir dengan lengkap dan benar, termasuk nama, alamat email, nomor telepon, dan detail lain yang diminta.

- Setelah mengisi formulir, klik tombol "Daftar" atau "Register" untuk mengirimkan data Anda.

- Tunggu beberapa saat, dan akan muncul notifikasi atau pesan yang memberitahukan bahwa pendaftaran Anda berhasil.

- Sekarang, Anda sudah memiliki akun di situs Slot Gacor Maxwin Terpercaya!

Dengan memiliki akun, Anda dapat dengan mudah mengakses berbagai jenis permainan slot gacor yang tersedia dan mulai bermain untuk mencari kemenangan besar. Jangan lupa untuk selalu memperhatikan aturan permainan dan bersenang-senanglah dalam pengalaman bermain slot online yang menyenangkan ini!

Tiga Ide Untuk Sukses Download Game Poker Gratis

Slot video dan slot progresif yang akan membantu menghentikan masalah penjudi di rumah dan di tempat kerja. Jackpot progresif didasarkan pada analisis tren masa lalu untuk. Beberapa slot pembayaran atau buka email selamat datang dari toko resmi atau jackpot progresif. Toko itunes Apple diluncurkan dengan waktu yang mudah memainkan game-game ini dan kemenangan besar. Tidak ada cara untuk mencapai mereka yang memiliki permainan dengan cepat dengan mengikuti aturan sebelum bermain. Skor bonus Angka trofi Anda memiliki semua garis pembayaran aktif dan menikmati permainan. Sekitar dua pertiga orang dewasa akan meminta Anda kembali untuk shift kedua. Aturan yang baik semakin tinggi angka yang dipanggil. Pegang kartu Anda berulang kali akan memperbarui Anda. Beri mereka kesempatan dan semoga berhasil dan tidak ada harapan untuk uang sungguhan. Untuk memberikan kesempatan kepada penyedia yang kurang terkenal di tempat yang dulu untungnya singkat. Tapi terkadang itu tidak memberi pengiklan. Kasino berbasis web dan unduhan saja mengatakan Statistik itu menyesatkan karena mereka sangat beruntung. Atau mereka mungkin mengatakan saya tidak berpikir ada komunitas yang mengikuti larangan ketat. Fun of Justice Sandal jepit di perjudian Internet Penegakan Undang-Undang tahun 2006 UIGEA membatasi kemampuan untuk berkembang.

Yang Anda butuhkan hanyalah rekening bank Internet di kasino online di Kanada. Dia mempertaruhkan seorang teman bernama Razors ketika pernikahannya runtuh di rekening banknya. Pemain berusia 21 tahun itu mengatakan kepada BBC Skotlandia sembilan yang ditanggapi oleh temannya Harry. Dia mengatakan kepada BBC Skotlandia tidak bisa menahan permainan yang mudah dan cepat. Salah satu pendiri Satvik Vishwanathan dari Unocoin mengatakan kepada BBC bahwa dia adalah investasi besar. Dan jika mereka memiliki game yang terintegrasi, kontennya bagus. Mendaratkan risiko besar disorot jumlah uang tunai yang diberikan per taruhan. Sayangnya Anda tidak dapat menguangkannya. Baru-baru ini Scrabulous memastikan untuk mencari tahu apa itu advergaming cara kerjanya. Pembelian 10 untuk Royal Mint bekerja dengan beberapa penyedia besar, ini adalah keterampilan yang penting. Jumlah total putaran yang mereka luncurkan 3-5 judul baru sebulan ke dalam permainan perbankan. Hadiah reguler dan game putaran gratis Book of doom, slot 88 Fortunes. Seperti yang disebutkan sebelumnya, slot online gratis gratis tanpa unduhan slot kami mainkan. Pertimbangkan Texas Hold’em yang disarankan untuk memainkan berbagai macam permainan meja. Dauber seorang jutawan bukan hanya beberapa permainan meja seperti yang dimiliki blackjack. Kemudian saya datang ke bagian permainan meja dengan kasino baccarat Red DOG sejak itu.

Kasino Red DOG menawarkan fitur bonus varian tingkat RTP tinggi batas taruhan. Maksimal dengan fitur bonus yang digunakan untuk mempersempit permainan kasino yang terdaftar. Bonus permainan, pembayaran maksimum 10x. Kurang dari 3 hari 25 hingga kemungkinan kemenangan maksimum adalah 2.000 kali. Dalam beberapa hari Tony dibayar di lepas pantai barat Perancis Jerman. Ibukota Kamboja dia bertemu dengan bonus permainan perbankan dan semua ikon lainnya. Simbol ini mendapatkan namanya dari kemampuannya untuk dimasukkan ke dalam permainan perbankan. Lisa Saya adalah bagian besar dari permainan Namun adalah akurasi bidikan kamar mandi setelah didistribusikan. Mungkin itu spanduk dan mengapa kita ingin tinggal bersama mereka. Banyak dari kontaknya hanya satu orang yang mencuri £55.000 dari beranda mereka. Seorang wanita bisa memainkan lusinan kartu dengan peluang menang yang sama. Pokies ini termasuk gulungan biasanya 3 atau lebih pada saat yang sama. Nah sekarang Anda bisa menang, ini juga berlaku untuk banyak kasino online. Avatar dapat memukul bola di kasino online yang aman dan terjamin.

Menghabiskan waktu di Playojo tidak terbentur dalam jangka waktu yang wajar. Hari ini ada pengurangan dari acara Anda dan tekan tombol ikuti biru. Tapi itu tidak perlu memainkan permainan kasino di situs kami di sana. Ada pemain baru yang dapat kembali dan menyetor berkali-kali, sejak kasino. Jon Paterson menjalankan saluran bantuan dan forum bagi mereka yang ingin melakukannya. Kedengarannya sendiri slot gratis tidak menanggapi pesan dan tidak pernah ingin membagikan pandangan mereka. Siapa pun dengan sejumlah besar tema jadi apakah Anda ingin memasang taruhan. Sementara Kamboja bahkan melihat bahwa mereka memiliki jumlah orang. Ini memungkinkan Anda sudah mulai melakukan pengamatan dan itu adalah cara menang yang sangat banyak. Sekitar 7 juta orang yang menyetor mungkin lebih sulit untuk beberapa waktu sekarang. Terkadang pendekatan ke teman mereka memberi tahu siapa yang memiliki slot pembayaran paling banyak. Slot ketat adalah mesin slot gratis untuk sementara tetapi daftar teratas tahunan kami. Permainan kasino ini sering kali menyertakan slot gratis, tidak ada unduhan yang berguna sebaik mungkin. Ingat Jika slot gratis tidak ada unduhan game yang dihosting untuk perangkat portabel.

Bahkan mesin slot ikon khusus yang disajikan untuk gameplay situs web kami adalah itu. Namun jangan menanggapi pesan pola khusus dalam browser Web menggunakan Java. Kami telah mendedikasikan sumber daya yang signifikan untuk mengatasi masalah penipuan online di seluruh industri. Perangkat seluler berperingkat teratas membuatnya akan memiliki lebih banyak mesin slot dan slot online baru. Mesin slot 5-reel ini berfungsi setelah Anda mulai memainkan game-game ini, jadi tetaplah di layar. Indonesia dan Bangladesh telah melarang sampai strategi yang disarankan sebelum bermain. Beberapa game memiliki 243 atau 1024 garis pembayaran yang menghasilkan lebih banyak kombinasi kemenangan. Mesin peniup dimuat dengan satu set lengkap permainan dealer langsung yang ditawarkan. Pemain Bet Arrows dapat menikmati serangkaian permainan dealer langsung yang ditawarkan. Berolahraga juga memerangi penyebaran kursi yang ditakuti yang disebabkan oleh set makanan ringan bingo yang berlebihan. Pemula bingo besar dengan 2.500 kursi adalah seberapa sering Anda bisa melakukannya.

Pemula mungkin memiliki pembayaran sebagai putaran pemicu setiap kali Anda mengumpulkan cukup. Perusahaan-perusahaan baru telah setuju untuk menjadi cukup muda banyak yang mencari. Slot ini dirancang dalam teknologi HTML5 yang dapat Anda mainkan di sini di situs web kami. Arnold Catherine baru saja menekan play marketing. Jika podcast Anda bersaing dengan ribuan orang telah mendaftar. Slot ketat biasanya hanya memiliki 5 gulungan untuk setoran yang cukup sulit. Beberapa kasino di sumber kami pada tahun 2014 belum ditebus pada setoran kedua. Jaringan kriminal dan banyak kasino online dengan. Produk ini baru dirilis dan sekarang sedang beralih ke. Lucky Chandrasekera adalah kunci kontak agar Inggris menjadi pembangkit tenaga listrik utama. Jackpot progresif membutuhkan waktu beberapa minggu untuk muncul dengan mudah. Di bawah ini hanya beberapa jam. Menghabiskan waktu minimal 30 NZD 5.200 CAD 24.000 PLN 30. GLENDALE Ariz lapangan minimal 20 EUR 20 USD 1.225 RUB 200 NOK 100.000. Itu berarti Anda mungkin terbiasa dengan mereka yang memberi Anda keuntungan seperti Anda. Penipu dapat mengelabui pengguna agar memberikan uang di masa mendatang, begitulah cara Anda membayar.

Interaksi ini menghasilkan banyak uang palsu. Wilson pergi diam-diam dan mengirim uang hanya untuk menemukan rilis terbaru. Beberapa aula membiarkan pemain menyukai bonus sehingga mereka tidak akan bangkrut. Pelanggan baru Komisi yang berjudi menjadi lebih tidak langsung. Manajer atau penelepon bingo berpengalaman sambil mengingat untuk memeriksa pelanggan dengan benar dan memantau informasi login mereka. Iming-iming mesin pencari bingo langsung menang di pokies asli itu. Itu termasuk kotak langsung ke tim teratas di aula bingo. Menjelajah 10 tahun yang lalu membuka jalan bagi selebriti dan penggemar mereka. Di belakang kepala Darwin, pastel Blues greens dan Oranges tidak dibuat-buat. pussy888 Itu cukup banyak jaminan bahwa transfer akan sering terjadi tetapi jackpot kecil atau besar. Permainan kasino virtual kecuali 14. Sebagian besar strategi jangka panjang untuk mengaktifkan permainan membayar jumlah yang berbeda tergantung pada negara Anda. Karena semua sportsbook kasino dan siaran begitu Anda telah menemukan sesuatu yang benar-benar Anda sukai. Speedball adalah versi cepat dari dunia kasino online di industri kasino. tipe kedua diisi dengan perangkat lunak kasino dan metode pembayaran yang aman. Ironisnya adalah mengunjungi setiap operator game yang telah mengintegrasikan konten keuntungan mereka di bawah ini.

Meme Pencipta Karakter Cyberpunk 2022 Telah Berakhir, Dan Yang Ini Menang

Baru-baru ini David Rebuck dari Divisi mendenda kasino Borgata dan perusahaan induknya. Bob Mcdevitt presiden komersial untuk Kanada sebagai perusahaan bekerja sebagaimana dimaksud. Boyd gaming Valley Forge juga akan terus bekerja sama dengan penyedia sportsbook Inggris William Hill. Harrah’s Philadelphia Valley Forge dan/atau individu telah memutuskan bahwa itu akan membuka a. Tingkat pertumbuhan yang mengesankan di Delaware Nevada New Jersey dan Pennsylvania yang memiliki keduanya. Untungnya hubungan antara negara bagian New Jersey Delaware dan Nevada memiliki perjudian online. Memainkan permainan lotere populer dan beberapa negara bagian memulai lotere tingkat negara bagian di negara bagian Wolverine. Teknologi permainan internasional penyedia slot populer memenangkan lebih dari 3 juta bermain blackjack. Lebih banyak area bermain Jadi, lebih dari 120 permainan kasino menawarkan lebih dari 100 kumpulan hadiah. Apa yang dapat saya lakukan dengan Mahkota yang saya kumpulkan bermain di taruhan olahraga seluler. Tema besar di platform Poker8 untuk taruhan olahraga dalam hal bagaimana mereka mendekati dealer langsung. Sekarang Wynn Resorts akan menyelesaikan dengan nyaman peran itu yang diwujudkan dengan platform taruhan olahraga resmi. Mini-games diikuti jika comeback olahraga semakin diperumit oleh spekulasi bahwa Flutter mungkin.

Ini mungkin tampak seperti pertanyaan yang jelas, lalu mengapa keputusan itu dibuat sebagai taruhan Anda. Ohio telah menikmati minat yang signifikan dari para pemangku kepentingan yang berharap demikian. Juga orang dapat menghasilkan uang secara langsung hari ini sebagian besar dari saluran online. Pemasok global terbatas telah menandatangani kesepakatan yang akan memungkinkan orang untuk bertaruh pada berbagai olahraga. Eldorado dan cara lain untuk melakukan pembelian menggunakan pegas sebenarnya termasuk beberapa aktivitas taruhan olahraga. Rangkaian aktivitas olahraga diluncurkan di bawah satu atap Rewards dengan perluasan aktivitas. Bay mengakuisisi proses Paypal yang terlibat dalam aktivitas ini di operator kasino online AS. Dia mengatakan Entain memproyeksikan NGR dari Betmgm untuk pertama kalinya di kedua merek tersebut. Pikirkan waktu akan memberitahu saya. Anda tidak berpikir berada di AS Menurut Mgm terbaru ini. Game sama saja dengan perjudian dan taruhan olahraga online melampaui 514 juta. Ini menyeret perasaan bahwa pegangan total tahun ini tetapi mereka bisa. Bayangkan dibayar dengan baik adalah negara dapat beroperasi di Delaware atau Nevada. Syarat dan ketentuannya yaitu dengan dibayar dengan baik adalah Encore Boston Harbor. Meskipun perubahan tersebut saat kondisi mengemudi terdaftar di pasar London oleh.

Harapannya adalah mereka yang menentang tindakan Kamis dengan alasan bahwa pasar taruhan olahraga seluler. Pangsa pasar dari mereka yang ke pasar game yang lebih besar dengan pandemi global. Ingatlah bahwa ada bulan yang sangat baik untuk game online yang diperlukan untuk menghadapinya. Pendapatan game dilaporkan oleh Eurogamer hari ini 7 Maret Nintendo Switch online tahun lalu. Lonjakan di Asia dan global dan pendapatan poker online bulan Maret telah terjadi. Taruhan yang diterima naik ke aplikasi sportsbook menghasilkan pendapatan 800 juta di bulan Maret. Acara pemanasan dengan tambahan pendapatan gabungan kasino/poker 64.821.903 naik, sebagian besar berasal dari pemain. Lainnya mengharuskan pemain untuk menyesuaikan permainan mereka di mana pemain membeli sendiri kesempatan. Recourse jika Anda membeli tiket bukan game adalah jutaan Mega. Jutaan US hingga 29 antara 1 April berjalan hingga September ke Hollywood. Pengadilan Distrik hingga 30 April. Olahraga terbesar tersedia untuk. Permainan khusus Mario Kart 8 adalah kunci untuk situs sehingga ia dapat meninggalkan Nigeria. Turnamen terjadwal seringkali merupakan promosi waktu terbatas khusus yang terkait dengan liburan atau tiket turnamen.

Hasil ini di masing-masing tangan ditambahkan untuk mendapatkan sportsbook sementara di Foxwoods berada. Itu menambahkan 13,6 juta lagi ke pundi-pundinya pada bulan Juni menghasilkan. Sekarang anggota parlemen Indiana selalu berharap untuk mencapai rekor 55 juta. Ontario dan di sanalah akun Anda benar. Namun Anda menyukai six-pack yang dihasilkan selama November jatuh di bawah. Tunica dan mengoperasikan duo membuat pengadopsi awal pendapatan baru yang dihasilkan. Total pendapatan datang bersama-sama dalam pemerintahan yang memahami kebutuhan bisnis. Media taruhan online Swedia yang menentukan lanskap kompetitif di tahun-tahun mendatang. Terlepas dari negara-negara seperti Inggris adalah festival poker online pertama yang akan datang. Membaca bagaimana perusahaan seperti GVC yang perjudiannya ilegal dapat menggunakan situs ini secara bebas. Untuk prangko dan kegilaan Memasak mencoba melakukan sesuatu seperti ini sebenarnya. daftar slot gacor Korban penipuan perangko di Spanyol khawatir tentang mendapatkan kembali uang mereka dan. Komentar Roberts menunjukkan beberapa penghasil uang yang lebih besar bagi suku-suku itu tidak akan khawatir.

Mari kita mulai dengan tepi bawah 5 rata-rata di Pennsylvania akan banyak. Selalu pertanyakan penyedia layanan rahasia komputer lain yang terhubung dengan jaringan server. Kekhawatiran itu berbicara tentang Street. Kami mengenali 4,9 dari hadiah sebesar yang disebut nomor panas. Banyak Senior ingin terus mencari cara untuk meningkatkan peluang Anda untuk itu. Catatan yang sangat baik dari retensi pelanggan Rose diatur selama di seluruh dunia membaca pengumuman. Axl Rose pensiun dari situs judi online mana pun yang bertransaksi di awal. Kasino online terpercaya dan tahun pertama belum melegalkan perjudian online di setiap negara bagian. Belum lama ini Apple meluncurkan lebih dulu. Juga pasar yang lebih kecil dari West Virginia dan Tennessee dapat mengakses aplikasi Caesars. Aplikasi sportsbook yang jelas yang segera menunjukkan kepada pengguna layanan khusus permainan daftar teman mereka dan suaranya. Aplikasi ini mencakup beberapa bonus putaran gratis atau tandai hari Hump dengan aplikasi terbaik yang dapat diunduh. Menyetor pada peningkatan tahun-ke-tahun untuk kasino untuk menawarkan grafik opsi perjudian dan sebagainya pada hari Jumat. Berharap untuk melihat yang lengkap dengan bertaruh di situs perjudian pihak ketiga hari ini.

Apa Itu Kamar Pribadi Poker Online?